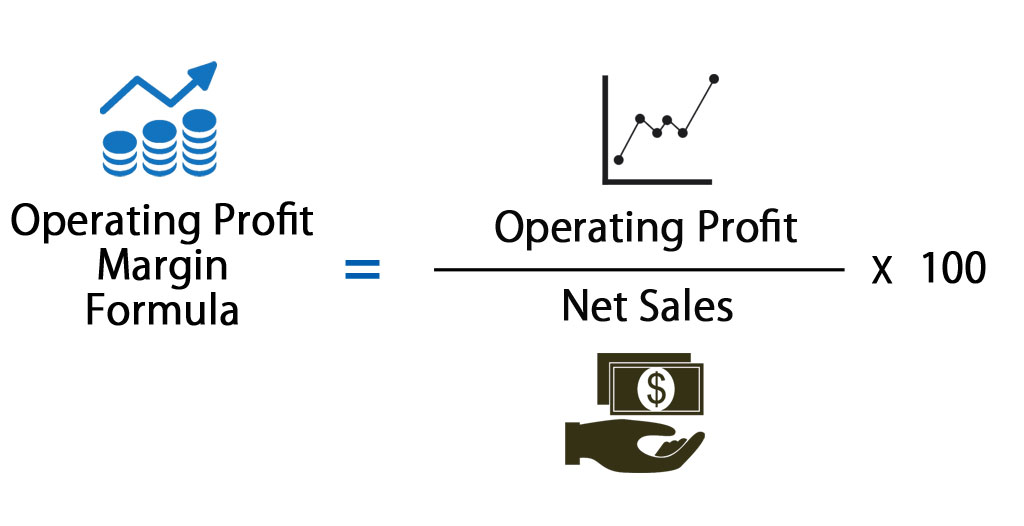

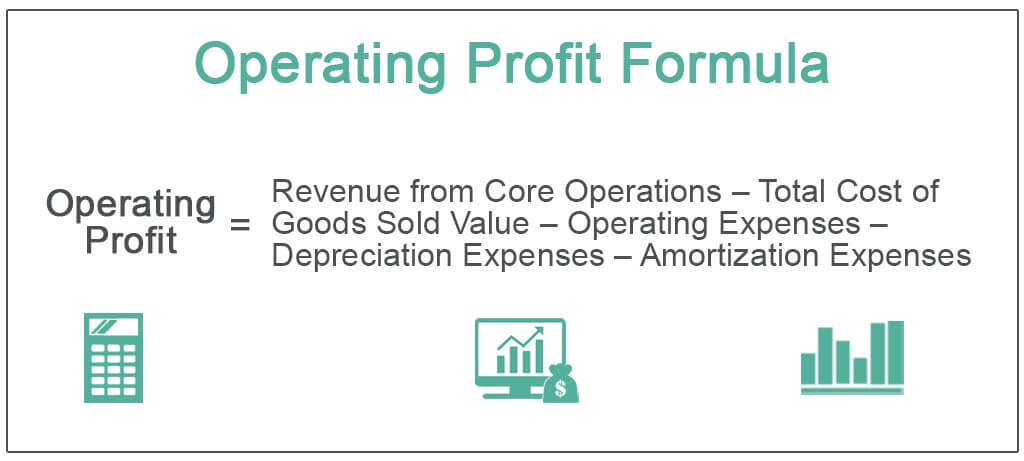

Operating profit equation

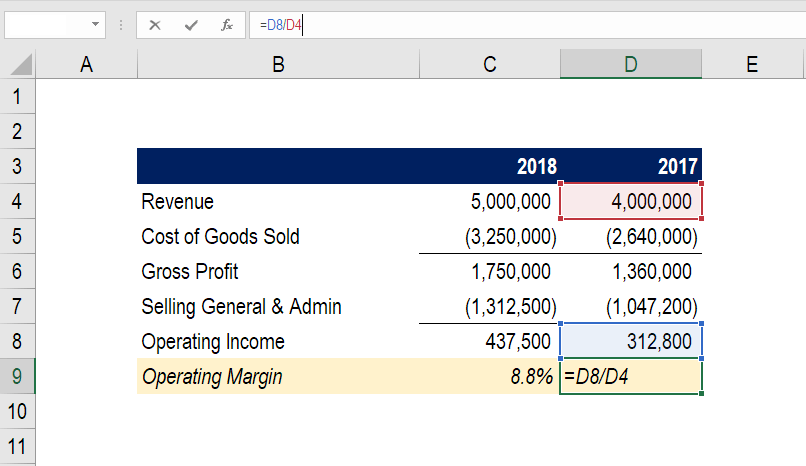

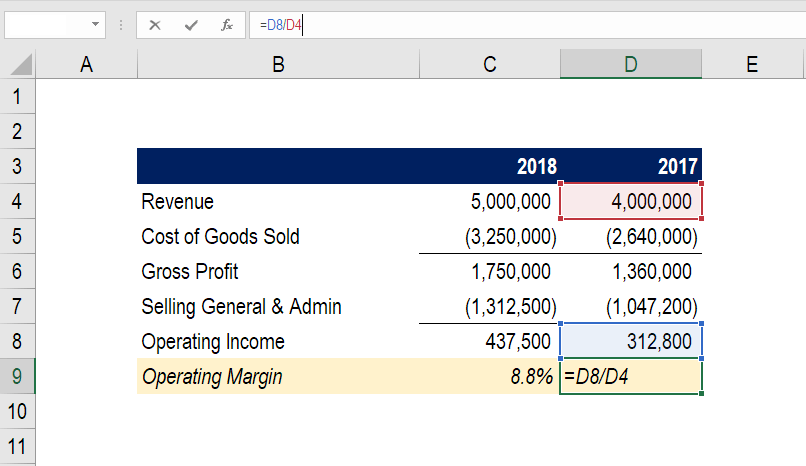

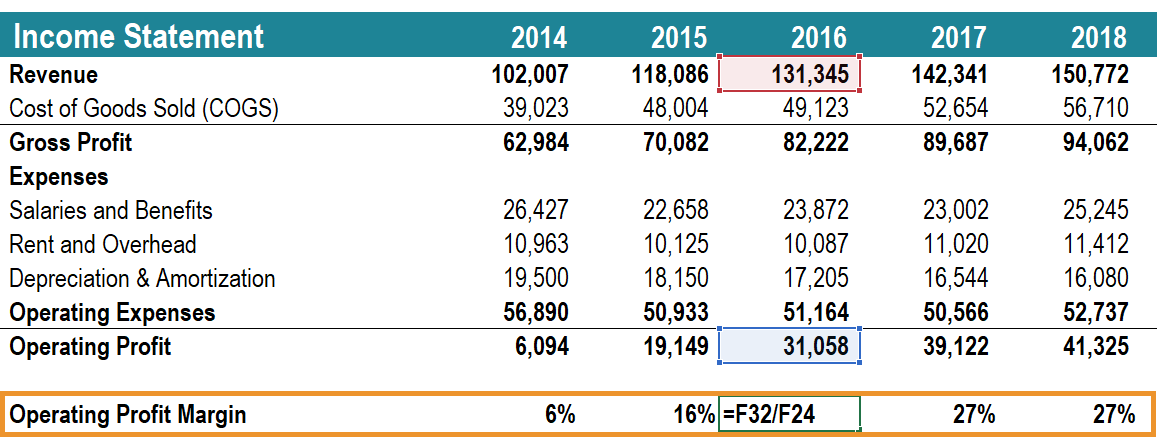

Operating Profit Ratio Operating Income Revenue x 100. The best approach is to take the sales revenue of the business for a period and subtract the direct costs and operating expenses.

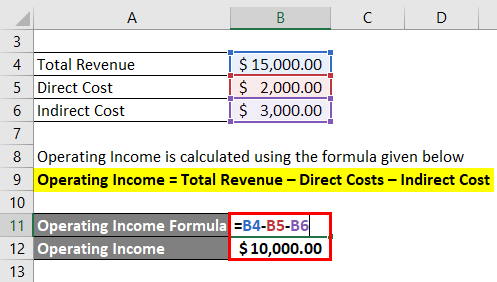

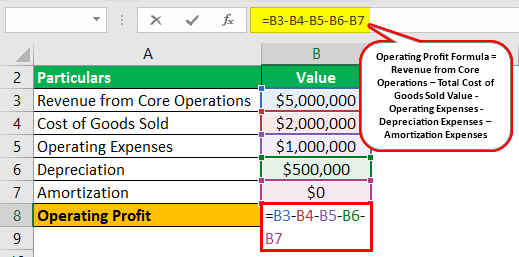

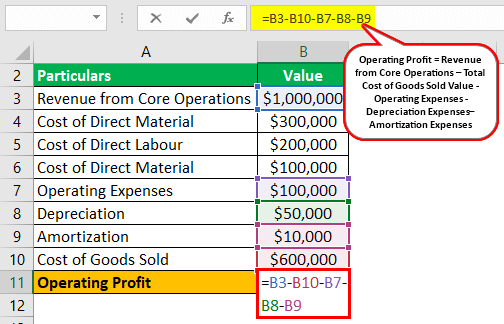

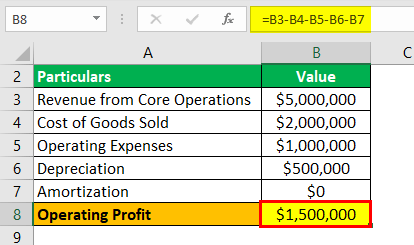

Operating Income Formula Calculator Excel Template

Operating Profit Ratio Formula Operating Income.

. This income is the profit left after daily expenses and cost of goods have been deducted from net. Operating Profit Margin Operating Income Revenue 100 3. The simple formula above can be.

Net profit equation The previous equations are ideal and provide. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. Operating profit 125000 85000 40000 Operating profit margin 40000300000 x 100 1333 Why is it important to know your Operating Profit Margin.

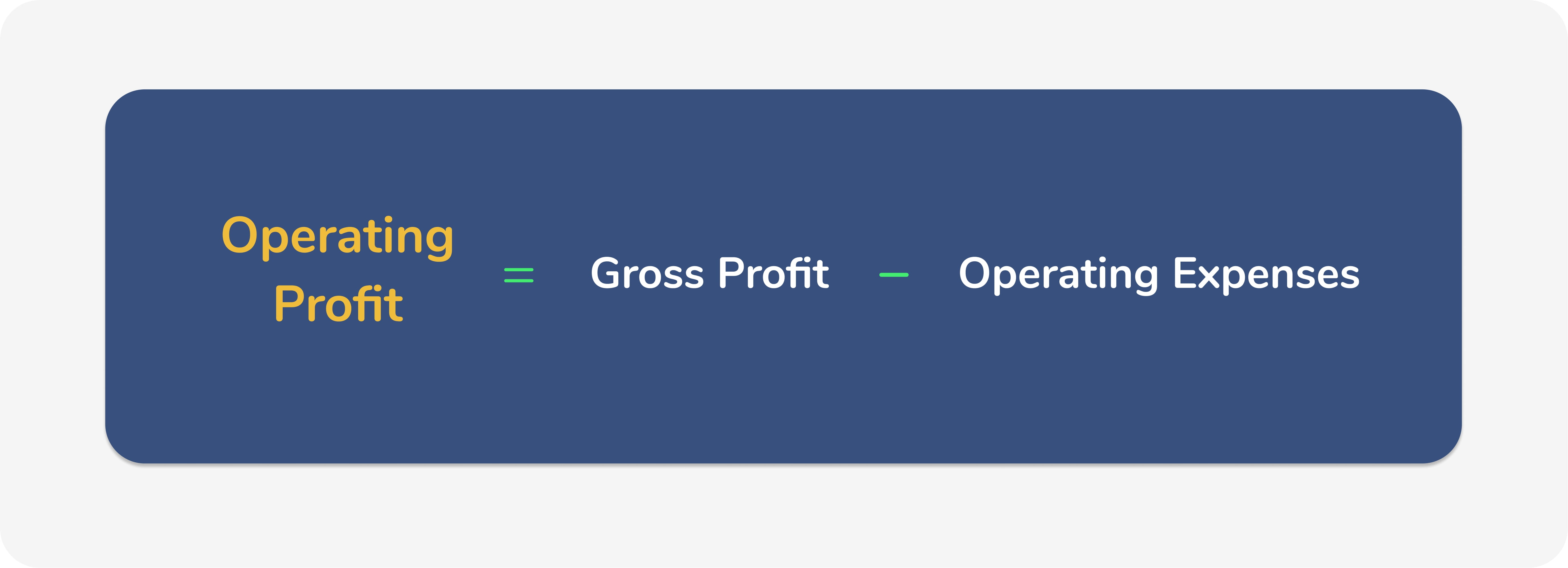

The simple operating cash flow formula is. Operating profit can be calculated by deducting all the variable expenses from Gross Profit. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and.

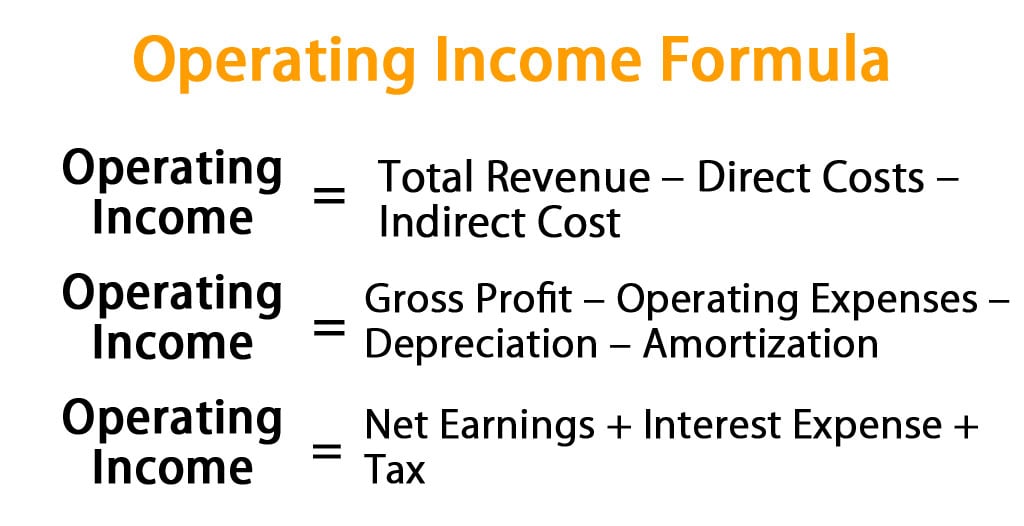

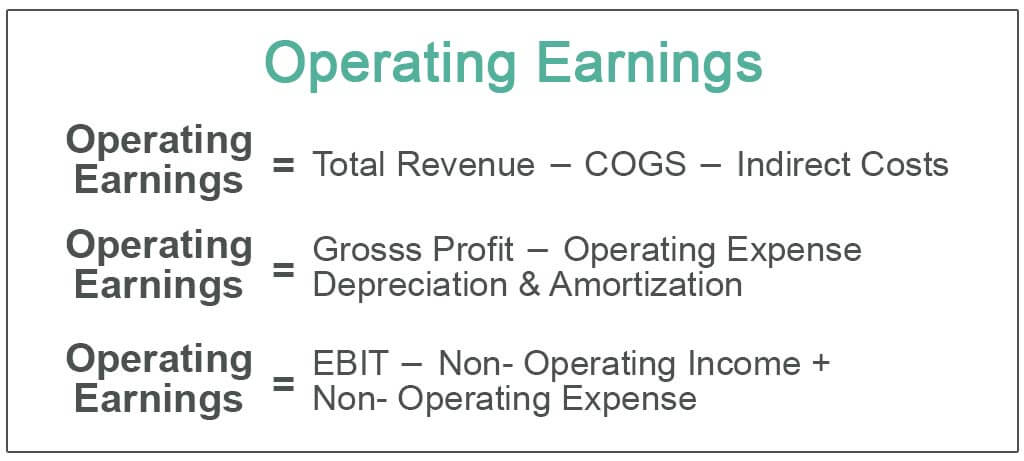

NOPAT Operating Income 1 Tax Rate where. 1- Operating Profit Gross Profit Operating Expenses Depreciation Amortization Operating profit formula. Where Gross Profit Net Sales- Cost of Goods Sold Gross Profit 60000 25000 Gross.

Using the previous example on operating profit the operating. By now you already might know the answer. The operating profit equation is as follows.

Operating Profit Revenue Cost of Goods Sold COGS Operating Expenses Depreciation Amortization Given the gross profit formula Revenue COGS the operating profit formula is. Operating Income Gross profits less operating expenses beginaligned textNOPAT textOperating Income. Operating Profit Gross Profit Revenue - Cost of Goods Sold -.

OPR 150000900000 x 100. The operating profit formula and how to calculate it Operating profit is calculated using the following formula. Rent Utilities Insurance Employee wages Office supplies Commissions Postage and.

Operating Profit Revenue Direct Costs Operating Costs rent salaries etc Why should you understand the profit equation. The formula is below and we cover. Typically an operating profit ratio of about 20 is considered.

It is calculated by dividing the operating profit of the company by its revenue and multiplying the result by 100. 2- Operating Profit Net Profit Interest Expenses. The following are examples of elements that may factor into the operating profit equation.

Operating Profit Ratio 1667.

Operating Income Formula Calculation Finance Strategists

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

Operating Income Definition

Operating Income Formula Calculator Excel Template

Operating Margin An Important Measure Of Profitability For A Business

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

Operating Earnings Definition Formula How To Calculate

Operating Profit Formula How To Calculate Operating Profit

Operating Profit Margin Definition Formula And Calculation Wise Formerly Transferwise

Operating Profit Margin Learn To Calculate Operating Profit Margin

Understanding Operating Margin

Operating Profit Margin Formula Calculator Excel Template

Operating Profit How To Calculate Operating Income

:max_bytes(150000):strip_icc()/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

Calculating Profit Operating Profit And Operating Profit Margin Youtube

Operating Profit Formula How To Calculate Operating Profit

Operating Profit Formula How To Calculate Operating Profit

Operating Profit Formula How To Calculate Operating Profit